The Behavior Gap — Your Biggest Enemy Is You

Most investors don’t lag the market because of fees alone — they lag because of timing mistakes.

Buying after big run-ups, selling after scary drops, switching strategies at the wrong moment — this is the behavior gap: the difference between what markets return and what the average investor actually earns.

This post explains why the gap appears, shows two simple experiments you can reproduce with real data, and gives you a practical playbook to narrow the gap — plus how Libra Invest helps you stick to it.

Why smart people make bad timing decisions

- Loss aversion: Losses feel ~2x as painful as gains feel good, so “cutting the pain” (selling low) feels rational in the moment.

- Recency bias: Recent drops feel like the “new normal,” so we hesitate to buy back.

- Overconfidence & FOMO: We chase what just worked, then arrive late.

- Noise overload: Headlines and social feeds magnify fear and hype.

The fix isn’t “be fearless.” It’s have a rule — and a setup that helps you follow it when emotions spike.

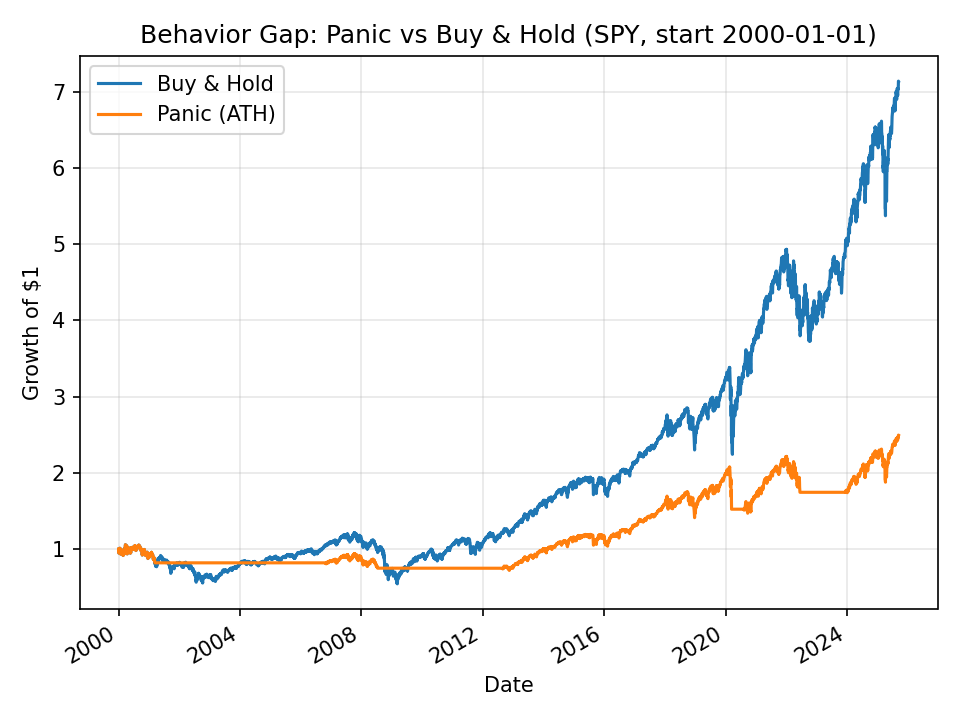

Experiment A — Panic rule vs. Buy & Hold (visualizing the gap)

This toy strategy sells when the portfolio is down –20% from its peak, and only re-enters at a new all-time high.

It feels safe — but historically, it often lags simple buy-and-hold because it misses recoveries.

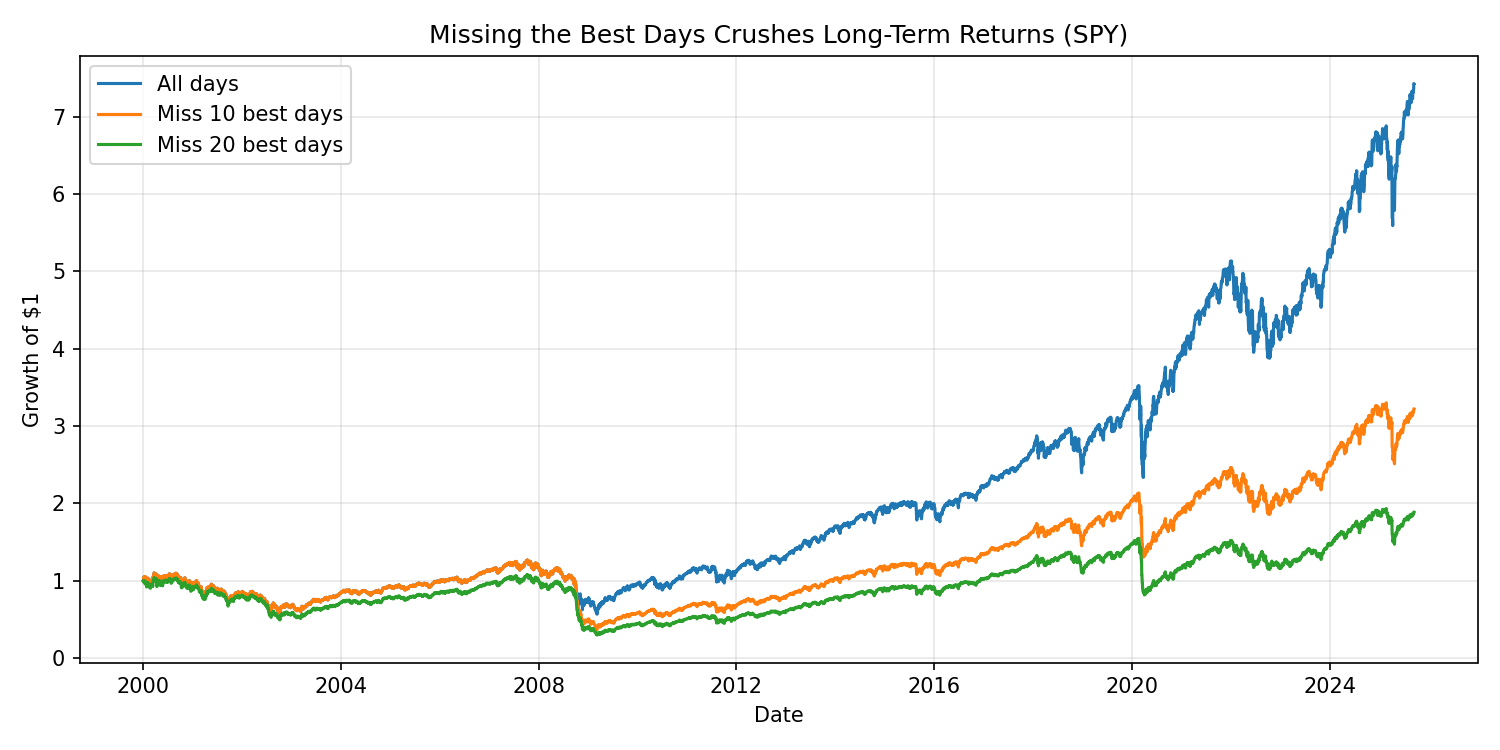

Experiment B — Missing the best days (the silent killer)

A handful of big up days can account for a huge chunk of long-term returns. If you’re out of the market during just a few of them, performance can collapse.

Practical playbook to close the gap

-

Write a one-sentence rule:

“I invest monthly, rebalance quarterly within ±5% bands, and never change strategy based on headlines.”

-

Automate contributions & rebalancing: Fewer manual decisions = fewer emotional errors.

- Use bands & cash flows: Fix drift mostly with new money/dividends to limit taxes.

- Add a cool-down clock: Require 24–48 hours before any allocation change. Most impulses fade.

- Match risk to temperament: If a 25–35% drawdown would make you bail, lower equity weight (e.g., 60/40).

- Check less often: Monthly or quarterly is plenty for long-term investors.

How Libra Invest helps (so discipline survives contact with volatility)

- Scenario previews: See realistic drawdowns and recovery timelines for your portfolio before markets get rocky — so you’re not surprised.

- Rules-based rebalancing: Gentle, within-plan nudges keep you aligned without chasing fads.

- Overlap X-ray: Avoid “diversification in name only,” which can make drops feel worse than expected.

- Plain-language guidance: Clear, unemotional explanations reduce panic-driven decisions.

Bottom line

The behavior gap isn’t about intelligence — it’s about emotion meeting money.

By using rules, automation, and real-world expectations, you turn big market swings into small, manageable decisions. That’s how long-term compounding stays intact.

Series navigation

← Previous: Defensive vs. Enterprising Investor

Next: The Behavior Gap »