Hidden Overlap ≠ Diversification — Don’t Own the Same Thing Twice

It’s easy to think “more ETFs = safer.” But if those funds all lean on the same handful of mega-caps or the same sector, you’re not spreading risk — you’re doubling down without realizing it.

Common example: an investor holds SPY (S&P 500), QQQ (Nasdaq-100), and a tech sector ETF like VGT/XLK. On paper it looks like three funds; in practice, it can be one trade repeated — a concentrated bet on U.S. large-cap tech. That means: - Bigger hit when that theme stumbles, - Rebalancing is less effective (everything moves together), - The portfolio’s true risk is higher than the owner expects.

This post shows quick checks you can reproduce, and how Libra Invest makes it effortless to catch overlap before it catches you.

Why overlap is a problem (in plain English)

- Concentration risk: If the same names dominate multiple funds, a single earnings shock can ripple through your “diversified” portfolio.

- Correlation spikes in stress: In sell-offs, related funds often move together — just when you hoped diversification would help.

- Illusion of control: More tickers feel safer, but the portfolio behaves like one concentrated position.

Goal: Each ETF should bring something distinct — region, size, style, or asset class — not just a new ticker symbol.

How to spot overlap quickly

1) Holdings X-ray (best): Look at the actual top positions and weights across your ETFs (this is what Libra Invest automates).

2) Return correlation (fast proxy): High correlation doesn’t prove overlap, but it hints that exposures are too similar.

3) Scenario behavior: If a few trackers all surge and sink together, you’re likely concentrated.

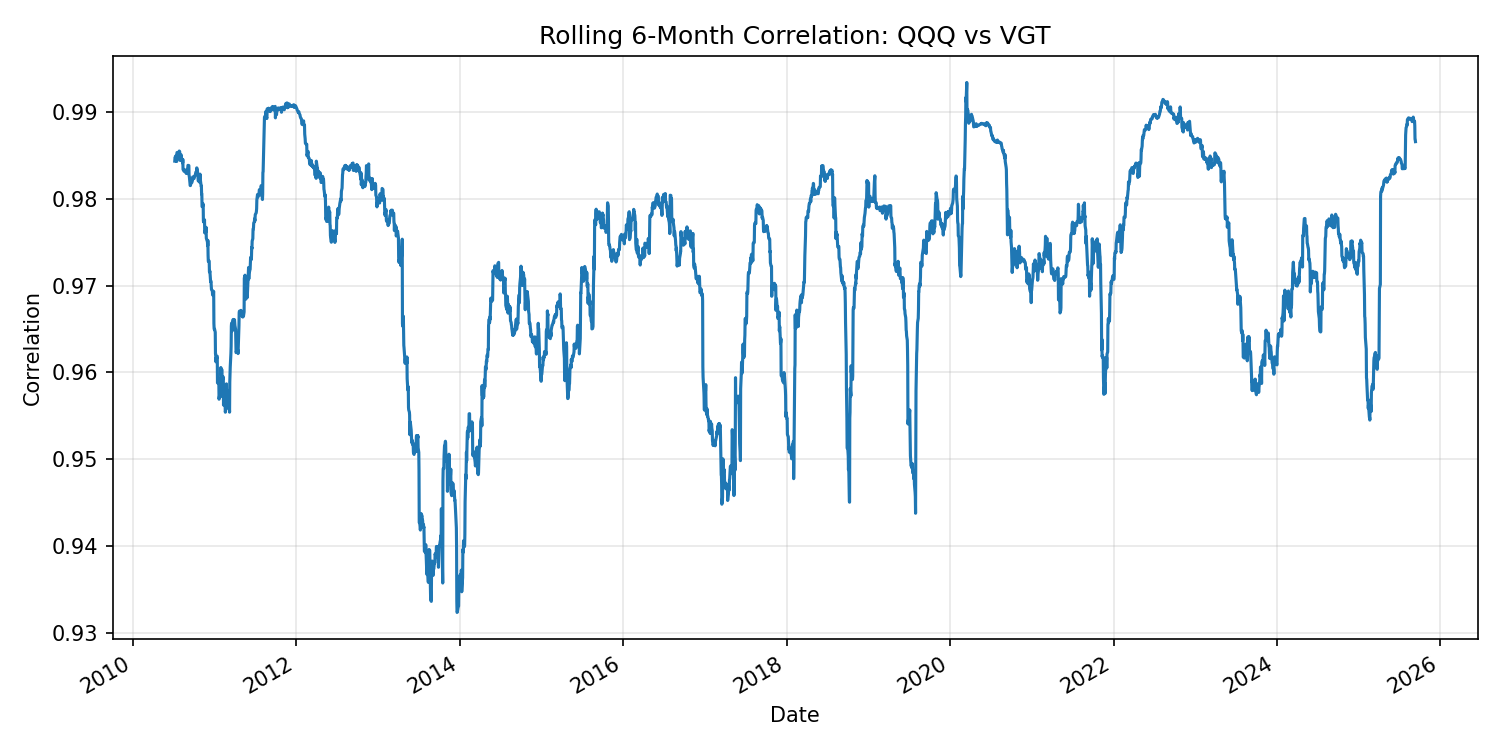

Figure A — Rolling correlation (QQQ vs VGT)

A simple sanity check: compare the 6-month rolling correlation of returns between QQQ (Nasdaq-100) and VGT (U.S. tech). Persistent, high correlation suggests the funds behave similarly — a red flag for redundancy.

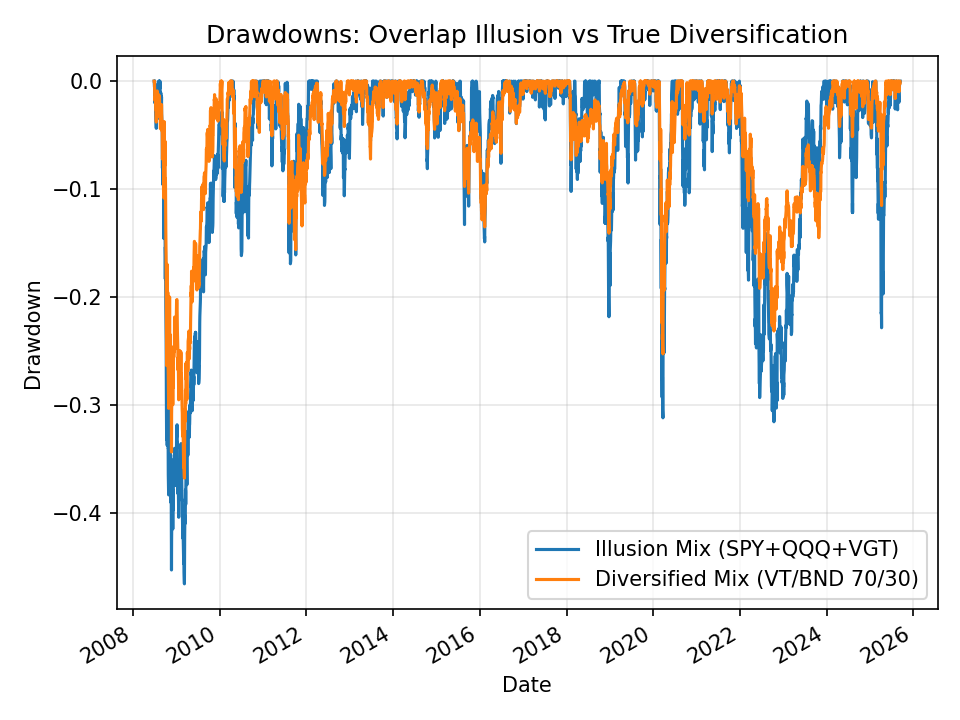

Figure B — “Looks diversified” vs “Acts diversified”

Let’s compare two simple mixes:

- Illusion mix (1/3 each): SPY + QQQ + VGT

- Diversified mix (70/30): VT (global stocks) + BND (core U.S. bonds)

We’ll chart drawdowns to see how each endures rough patches.

Note: Correlation is only a proxy for overlap — two funds can be highly correlated without holding the same names, and vice versa. That’s why a holdings-level X-ray is the gold standard.

Beginner checklist — build real diversification

- Start broad: Use a core global equity ETF (e.g., VT or a local equivalent) + a quality bond ETF.

- Add with purpose: Only add sector/factor funds if they play a distinct role.

- Cap theme exposure: Avoid stacking overlapping funds (e.g., SPY plus QQQ plus tech sector).

- Check overlap explicitly: Look at top holdings and weights; don’t rely on ticker count.

- Monitor behavior: If multiple funds surge and sink together, you’re not as diversified as you think.

How Libra Invest helps (and makes it easy)

- Holdings-level overlap scan: Instantly see where ETFs duplicate exposure (same stocks/weights) so you can reduce hidden concentration.

- Whole-portfolio view: Risk and scenario analysis show plausible drawdowns and recovery times for your combined holdings.

- Clear recommendations: Plain-language guidance helps you swap redundant funds for complementary ones — without strategy-chasing.

- Disciplined upkeep: Market-aware rebalancing keeps your distinct sleeves balanced over time.

Bottom line

Owning more funds isn’t the same as owning different funds.

By spotting and removing overlap, you restore the core benefits of diversification: smaller worst-case declines, steadier compounding, and fewer surprises.

Series navigation

← Previous: The Behavior Gap

Next: (end of series) Back to Series Index

← Previous: The Behavior Gap »

Next: (end of series) Back to Series Index