Margin of Safety (Diversification) — Build Buffers Against Uncertainty

Benjamin Graham’s “margin of safety” is the idea that you should leave yourself room for error because the future is uncertain.

For long-term ETF investors, the most practical way to build that margin is diversification — spreading risk across assets that don’t all rise and fall together.

But here’s the catch: owning many tickers isn’t the same as being diversified.

Five ETFs can still be the same big tech stocks in disguise, which quietly concentrates your risk.

This article explains what real diversification looks like (in plain English), shows you two quick charts you can recreate, and describes how Libra Invest helps you avoid the most common pitfalls with clear analysis and overlap checks.

What diversification is (and isn’t)

- IS: Mixing different economic bets — e.g., global stocks + quality bonds; large caps + small caps; U.S. + international; possibly REITs or commodities for some investors.

- ISN’T: Collecting tickers that all lean on the same handful of mega-caps. That’s an illusion of diversification (lots of funds, same exposure). :contentReference[oaicite:1]{index=1}

Why it matters:

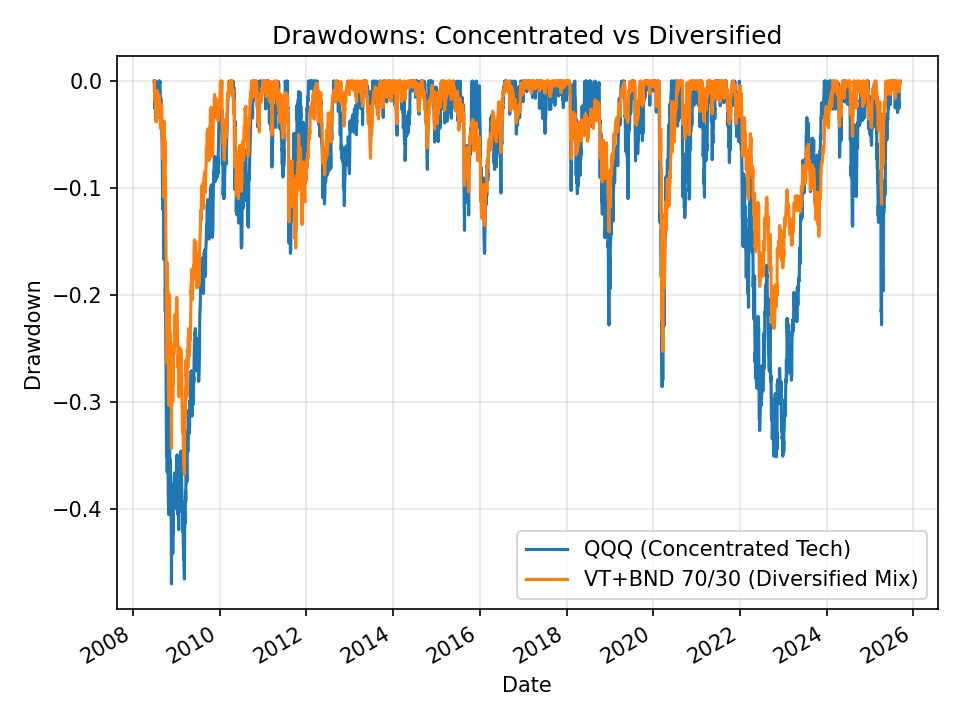

- A single theme (say, U.S. large-cap tech) can have steep drawdowns. If your “diversified” portfolio is just that theme repeated, your downside is bigger than you think.

- A real mix can narrow the range of outcomes, reduce worst-case drawdowns, and make it easier to stay invested through scary headlines — which is the whole game.

How Libra Invest helps you get it right

- Overlap & concentration X-ray: Libra scans your ETF mix for hidden overlap and flags where you’re “doubling up” on the same holdings across funds, helping you build diversification that’s real, not just on paper.

- Risk & scenario analysis: See plausible drawdowns and recovery times for your whole portfolio before the next downturn, so nothing surprises you — clarity makes it easier to stick to the plan. :contentReference[oaicite:3]{index=3}

- Plain-language guidance: Visuals and summaries translate the stats into decisions you can actually use. :contentReference[oaicite:4]{index=4}

Two quick figures you can generate

We’ll create:

1) Concentrated vs diversified drawdowns (QQQ vs a VT+BND 70/30 mix).

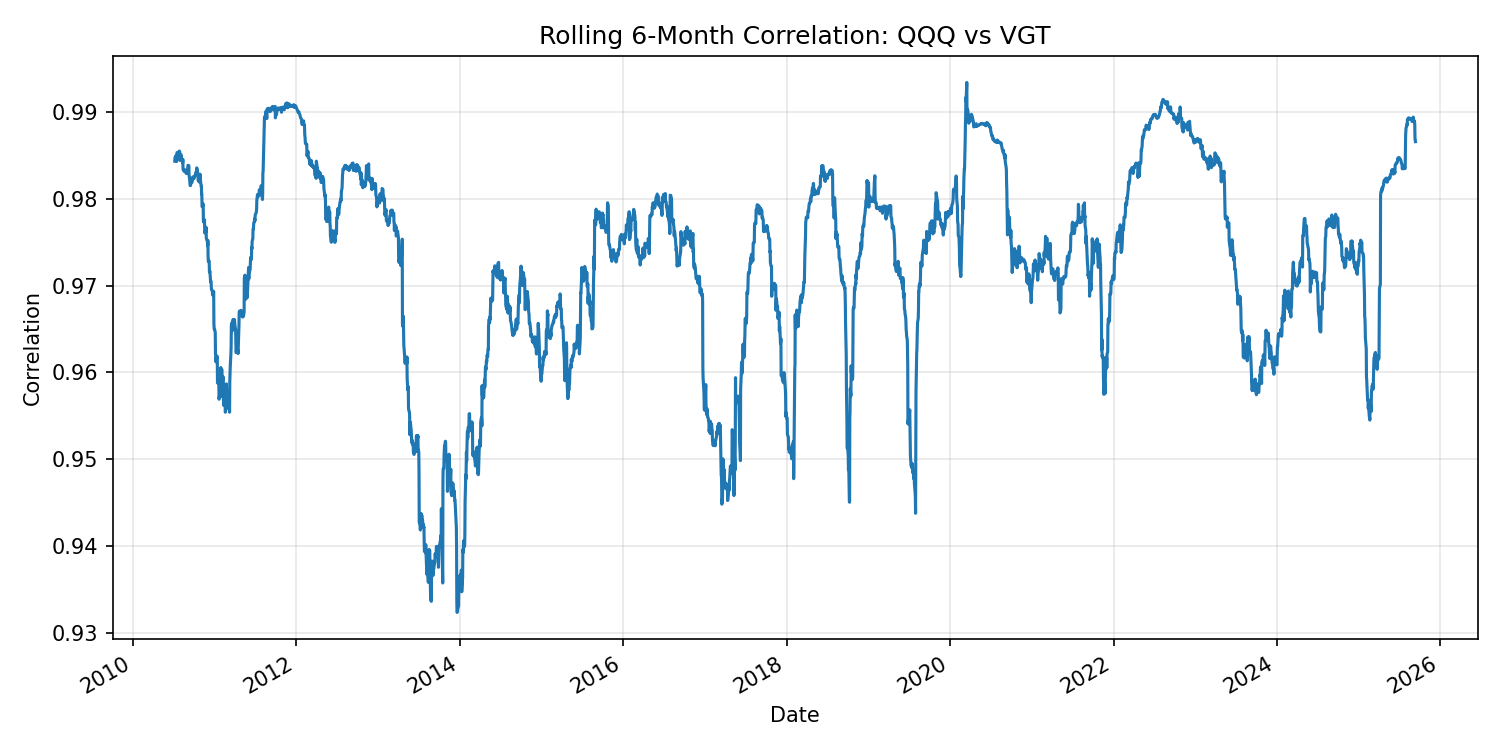

2) Rolling correlation between QQQ and VGT as a redundancy proxy (helpful intuition: high correlation often means similar drivers — not identical to holdings overlap, but it warns of potential sameness).

Figure A — Concentrated vs diversified drawdowns

Figure B — A quick redundancy proxy (rolling correlation)

Putting it all together (beginner checklist)

- Own the core first: One broad global equity ETF + a quality bond ETF is a powerful baseline.

- Add with purpose: If you add a sector or factor fund, know what unique role it plays — and verify it isn’t mostly duplicating your core.

- Watch the whole-portfolio picture: Look at combined risk, not just single-fund returns.

- Rebalance gently: Keep your mix aligned to your risk tolerance (calendar or bands).

- Use tools that reveal overlap: Don’t rely on ticker count; rely on exposure clarity.

Why this supports Graham’s “margin of safety”

Diversification is the practical form of humility: it admits we can’t predict which theme will shine next.

By spreading risk across independent drivers — and verifying we’re not just repackaging the same bet — we reduce the damage of being wrong and improve our odds of staying invested for the long run.

Libra Invest makes this easy by quantifying risks, surfacing hidden overlap, and presenting it in plain language so you can make confident, informed decisions.

Series navigation

← Previous: Mr. Market & Rebalancing

Next: Defensive vs. Enterprising Investor »

← Previous: Mr. Market & Rebalancing

Next: Defensive vs. Enterprising Investor »