Mr. Market & Rebalancing — Be Polite, Not Impressionable

Benjamin Graham personified the market as Mr. Market — a partner who shows up every day offering to buy or sell at whatever mood strikes him. Some days he’s euphoric, other days he’s gloomy. Graham’s advice: don’t mirror his mood. Use his offers when they help you; ignore them when they don’t.

For long-term ETF investors, the practical translation is rebalancing. Instead of predicting what comes next, you follow a simple rule: periodically trim what’s surged and add to what’s lagged, keeping your portfolio aligned with your plan. It’s a disciplined way to “buy low / sell high” without fortune-telling.

Rebalancing 101 (in plain English)

- What it is: You start with a target mix (say, 60% stocks / 40% bonds). Over time, winners run ahead and losers fall behind; your mix drifts (e.g., 70/30). Rebalancing nudges it back to 60/40.

- Why it helps:

- Keeps risk consistent (your portfolio doesn’t accidentally become “all stocks”).

- Systematically takes small gains from assets that ran hot and adds to cheaper ones.

- Reduces regret: you act on a plan, not on headlines or hunches.

- How often? Two common approaches:

- Calendar-based: quarterly, semiannual, or annual. Simple, predictable.

- Threshold-based: rebalance only when a position drifts by a band (e.g., 5/25 rule: rebalance if an asset deviates by 5 percentage points or by 25% of its target, whichever is larger).

- Costs & taxes: Rebalance inside tax-advantaged accounts when possible; in taxable accounts, favor new contributions/withdrawals to do most of the work and minimize realized gains.

Where Libra Invest fits

- Keeps the plan front and center: You’ll know your intended risk and how it behaves under different scenarios, which helps you stay disciplined when markets get loud. :contentReference[oaicite:0]{index=0}

- Smart, market-aware rebalancing: Instead of raw calendar flips, Libra’s engine uses data (seasonality cues, market structure signals, and other quantitative inputs) to make gentle, within-plan adjustments each quarter — not strategy chasing, just smarter execution.

- Avoids hidden concentration: If several ETFs are quietly doubling up on the same mega-caps, Libra flags that so rebalancing works on a truly diversified base. :contentReference[oaicite:2]{index=2}

Think of it as adding a calm co-pilot: same destination, steadier ride. You remain passive, but you avoid drift and emotional zig-zags. :contentReference[oaicite:3]{index=3}

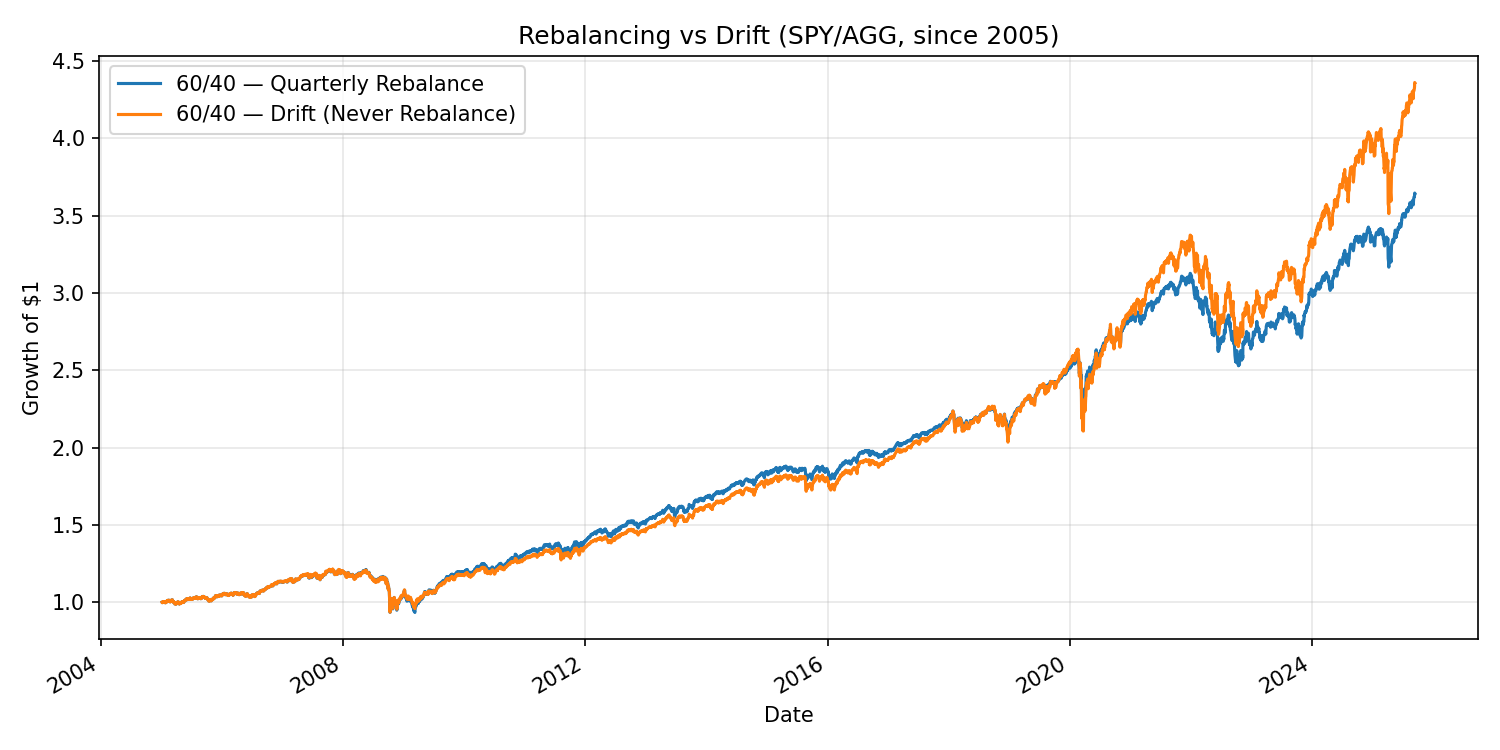

A small experiment: 60/40 with and without rebalancing

Let’s compare two simple portfolios from 2005 onward:

1) 60/40 SPY/AGG with quarterly rebalancing

2) 60/40 SPY/AGG that’s never rebalanced (it just drifts)

Does rebalancing always “win”?

Short answer: no — and that’s okay.

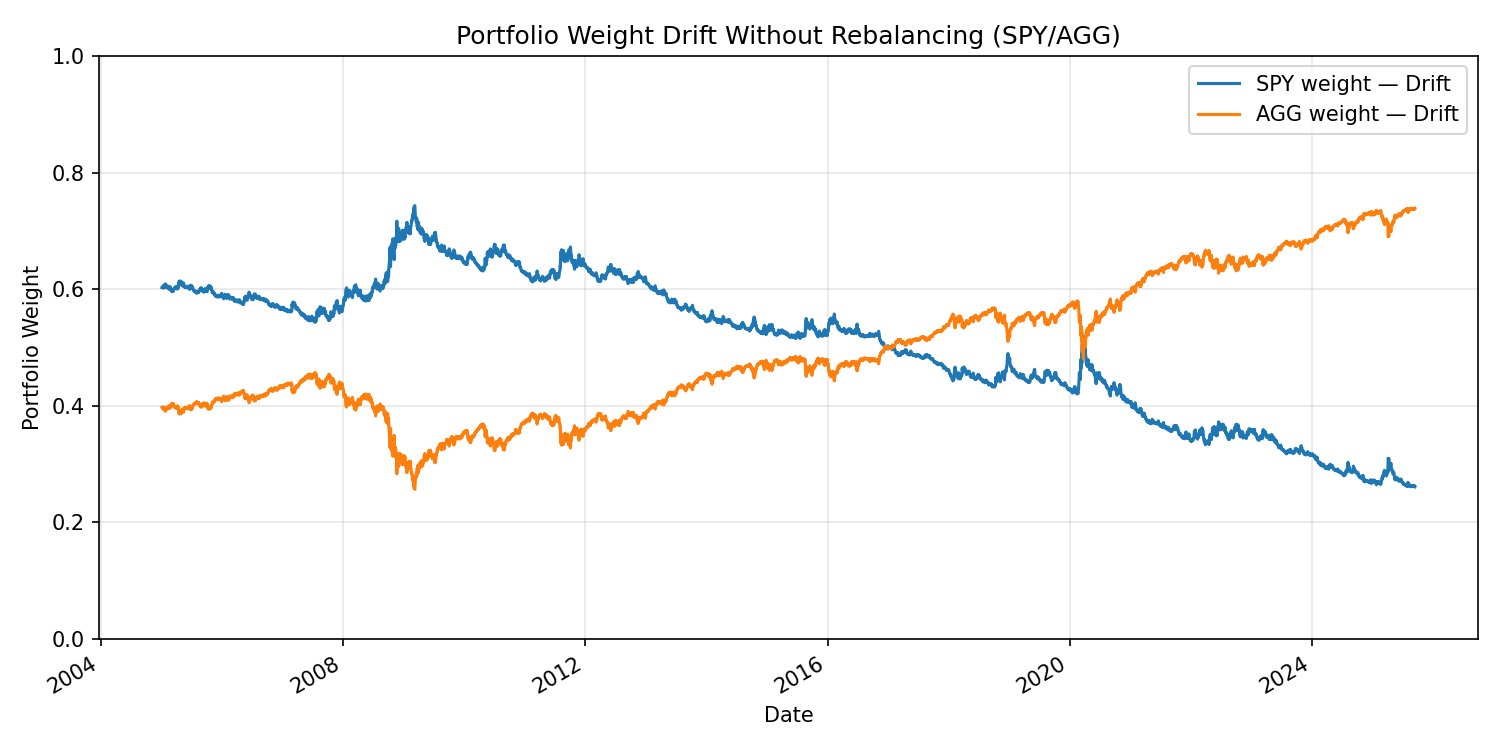

In long bull markets, a drifted portfolio often shows higher returns because it quietly becomes more stock-heavy. You didn’t “beat” rebalancing; you took more risk. Rebalancing’s job isn’t to maximize returns at all costs — it’s to keep your risk where you intended, reduce regret, and avoid waking up accidentally 80/20 when you wanted 60/40.

What to look at (beyond return):

- Volatility & max drawdown: Did the higher return come with much deeper losses?

- Risk drift: How far did the equity weight wander from the plan?

- Worst calendar year & sequence risk: Important if you’re withdrawing (retirees).

- Taxes & behavior: Rebalancing with contributions can reduce taxes and second-guessing.

Libra Invest’s approach is to keep you within your plan (bands & gentle, market-aware nudges), so you get the discipline benefits without needless churn.

Practical tips (taxes, costs, and sanity)

-

Do most of your rebalancing with new money (and dividends).

That fixes drift while minimizing sales in taxable accounts. -

Pick a cadence that fits your life.

Quarterly or semiannual is fine; the important part is doing it consistently. -

Use bands for flexibility.

If you prefer, only rebalance when drift exceeds a threshold — that can reduce trading and taxes. -

Document your rule in one sentence.

Example: “Each quarter, I rebalance my 60/40 back to target within a ±5% band.”

When markets get noisy, you’ll be glad you wrote it down.

The big idea

Rebalancing is the quiet habit that lets you benefit from Mr. Market’s mood swings without becoming moody yourself.

It keeps risk where you intended, turns volatility into small opportunities, and replaces hunches with a steady rule.

Libra Invest’s market-aware rebalancing keeps you in bounds and explains the “why” behind each nudge, so the habit sticks even when the headlines don’t.

Series navigation

← Previous: Focus on the Investor, Not the Market

Next: Margin of Safety (Diversification) »