Focus on the Investor, Not the Market

If you’re just starting out in investing, it’s natural to wonder: “What will the market do next?”

Benjamin Graham — the father of value investing — argued that this is the wrong question. Instead of asking what the market will do tomorrow, intelligent investors ask: “What should I do to stay safe and grow steadily, no matter what the market does?”

That’s the essence of this principle: investing success depends more on your behavior than on the market’s behavior. Prediction is a gamble; discipline is a plan.

Why this matters

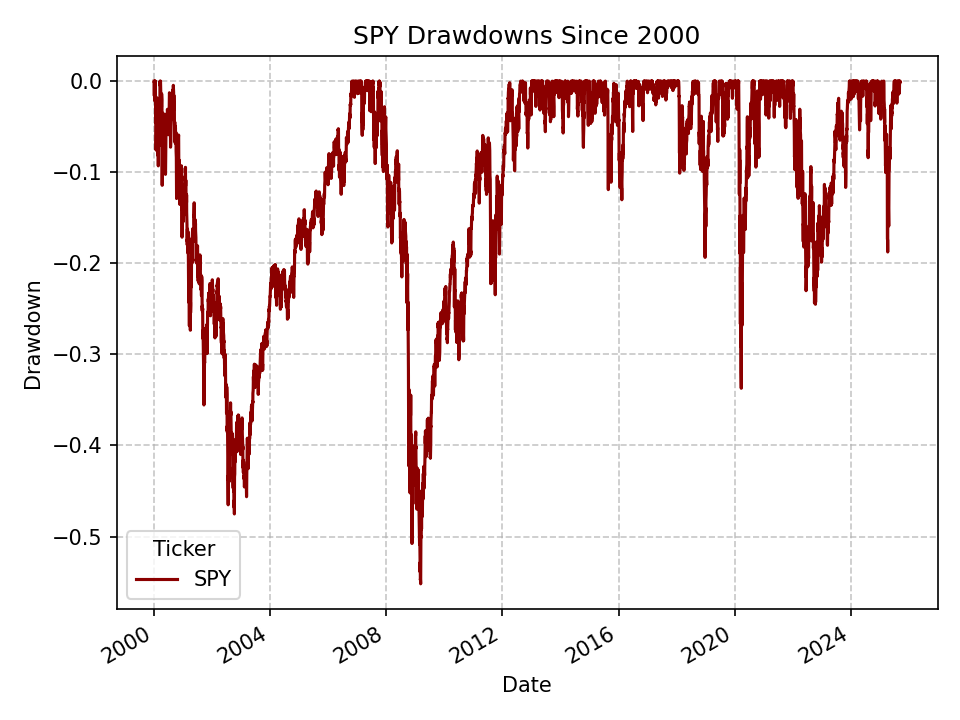

- Markets go through cycles of euphoria and fear. Even strong indexes like the S&P 500 (SPY ETF) have suffered deep downturns.

- A beginner investor might see a headline like “Stocks Crash 30%!” and think: “I must sell before it gets worse.”

- But historically, markets have recovered — often faster than expected. The people who bailed out usually missed the rebound.

So the lesson is simple:

👉 If you know in advance that downturns are normal, you’re less likely to panic when they happen.

How Libra Invest helps

Libra Invest was designed to give you that exact clarity:

- It runs risk & scenario analysis on your ETF portfolio:contentReference[oaicite:1]{index=1}.

- You can see what a 20% or 30% downturn might look like in your own plan.

- It even shows recovery timelines based on history, so you know what to expect before it happens.

This transforms anxiety into preparedness. Instead of reacting emotionally, you stay on track because you already understand the possible outcomes.

A visual proof: Drawdowns are normal

Here’s a chart you can generate with a short Python script. It shows the historical drawdowns (drops from previous highs) of SPY since 2000. You’ll notice sharp drops — but also that every drop eventually recovers.

The resulting chart makes it clear: downturns are part of the journey, not the end of it.

Key takeaway for the investor

- Don’t obsess over the market’s daily moves.

- Understand that you — your discipline and patience — are the main driver of success.

- With the right preparation, downturns become bumps in the road, not disasters.

And this is exactly what Libra Invest is built for: turning timeless wisdom into a modern, data-driven habit.

Series navigation

← Previous: (index) Investment Wisdom Series

Next: Mr. Market & Rebalancing »