Real Estate: A Steady Diversifier in Inflationary Times

At Libra Invest, we stress the importance of diversification. Stocks drive long-term growth, but when they falter, other assets can provide stability. One such asset is real estate, which has historically offered mid-range returns with valuable diversification benefits.

The Long-Term Picture

From 1928 to 2024:

- Average annual return: 4.4% (lower than equities, higher than T-Bills).

- Volatility: 6.2%, much lower than stocks.

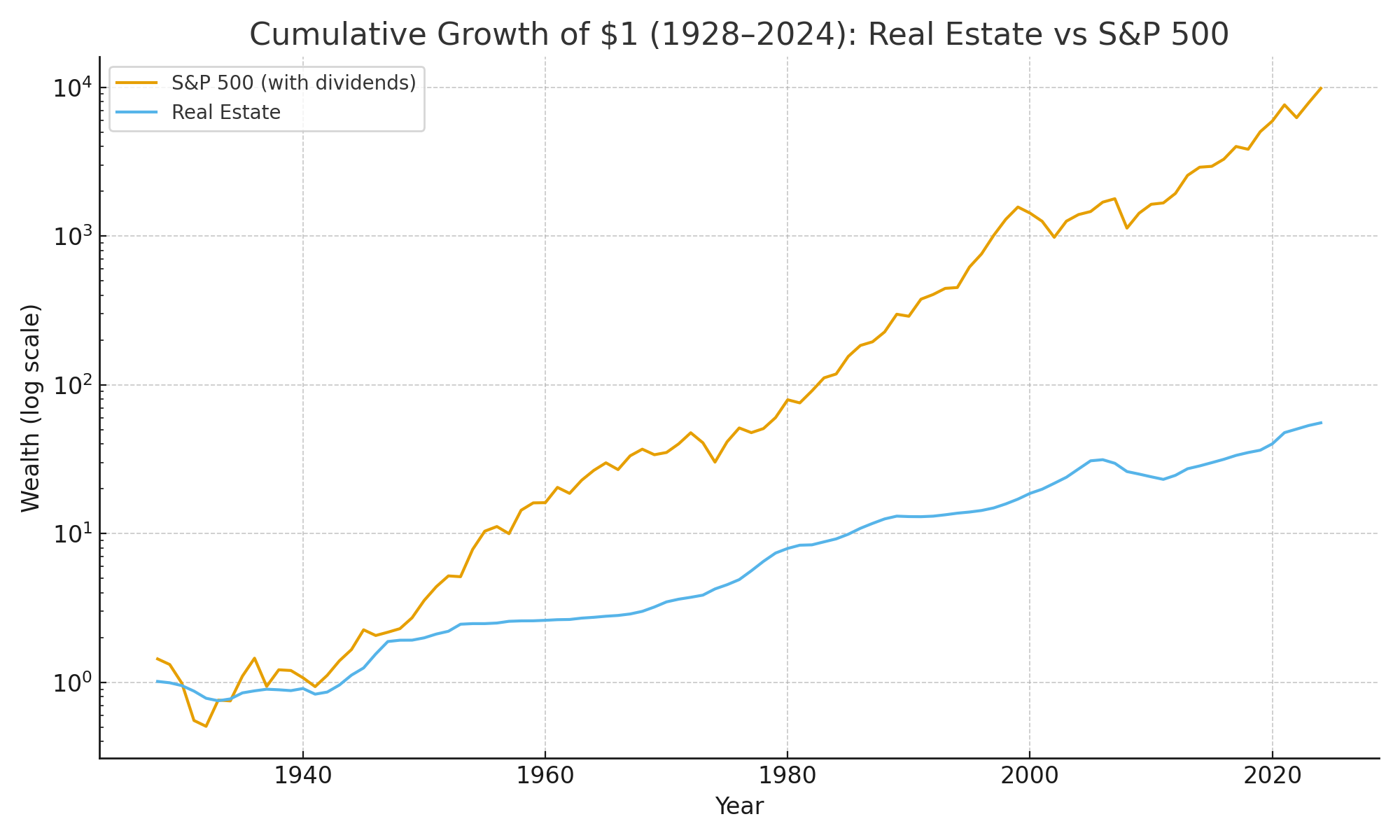

A dollar invested in real estate in 1928 grew to about $5,553 by 2024 — far behind the S&P 500’s ~$983,000. But the value of real estate comes not in absolute returns, but in how it behaves differently from equities.

A Shelter in the Storm

Real estate often shines in inflationary or difficult equity environments:

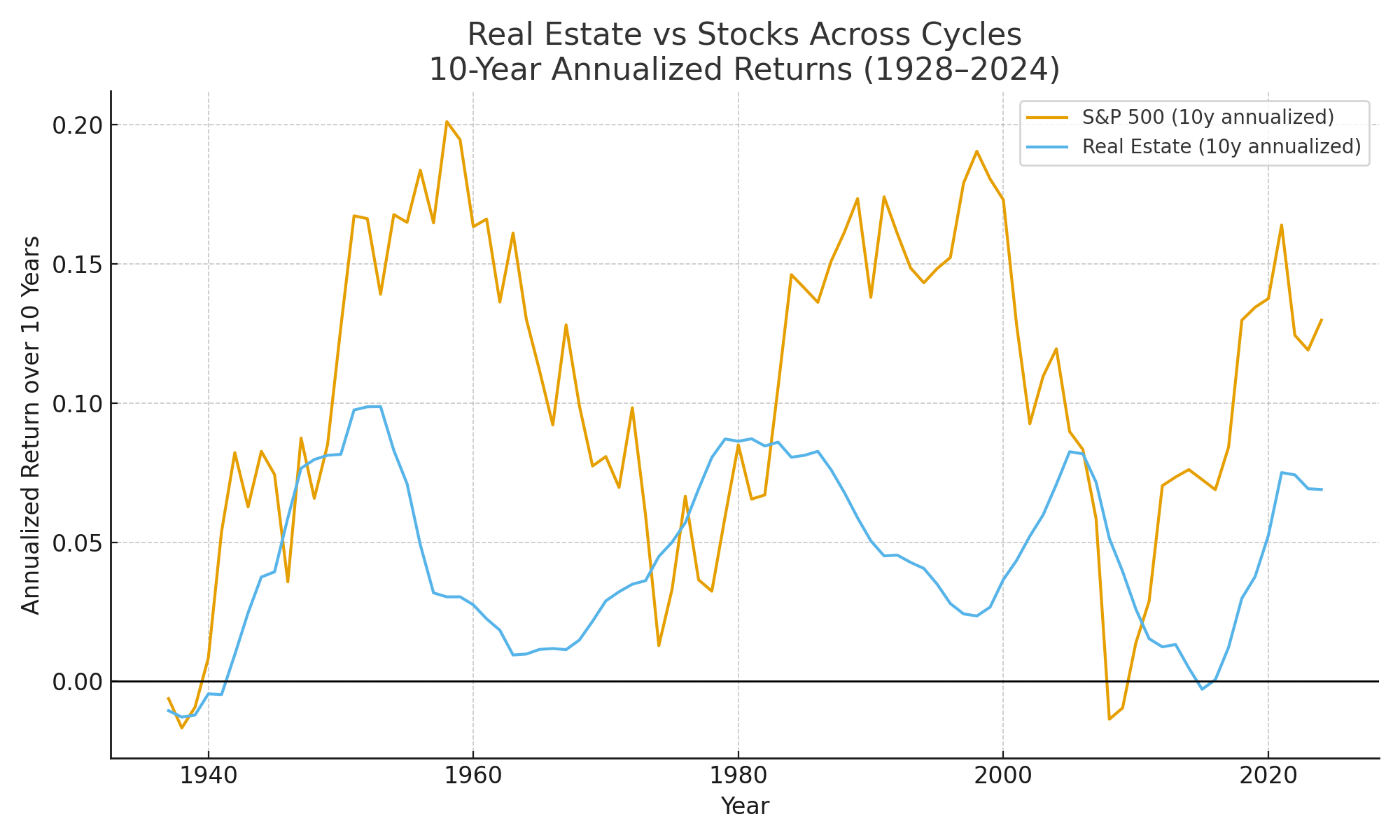

- 1970s: S&P 500 returned –14% over the decade, while real estate gained +68%.

- 2000–2002 bear market: Stocks lost 38% in total, but real estate delivered steady positive gains.

Looking at rolling 10-year periods, you can see how real estate provided resilience when equities struggled.

The Investor’s Takeaway

Real estate on its own won’t make you rich compared to equities. But as part of a diversified portfolio, it provides stability and inflation protection, particularly during times when stocks disappoint.

At Libra Invest, we believe the lesson is clear: while equities are the growth engine, real estate plays the role of ballast — keeping portfolios afloat during turbulent waters.