Stocks vs Gold — A Practical Guide for Long-Term Investors

Stocks build wealth; gold stores value. This post shows when each has led — and how a small gold sleeve can steady a long-term, stock-led portfolio.

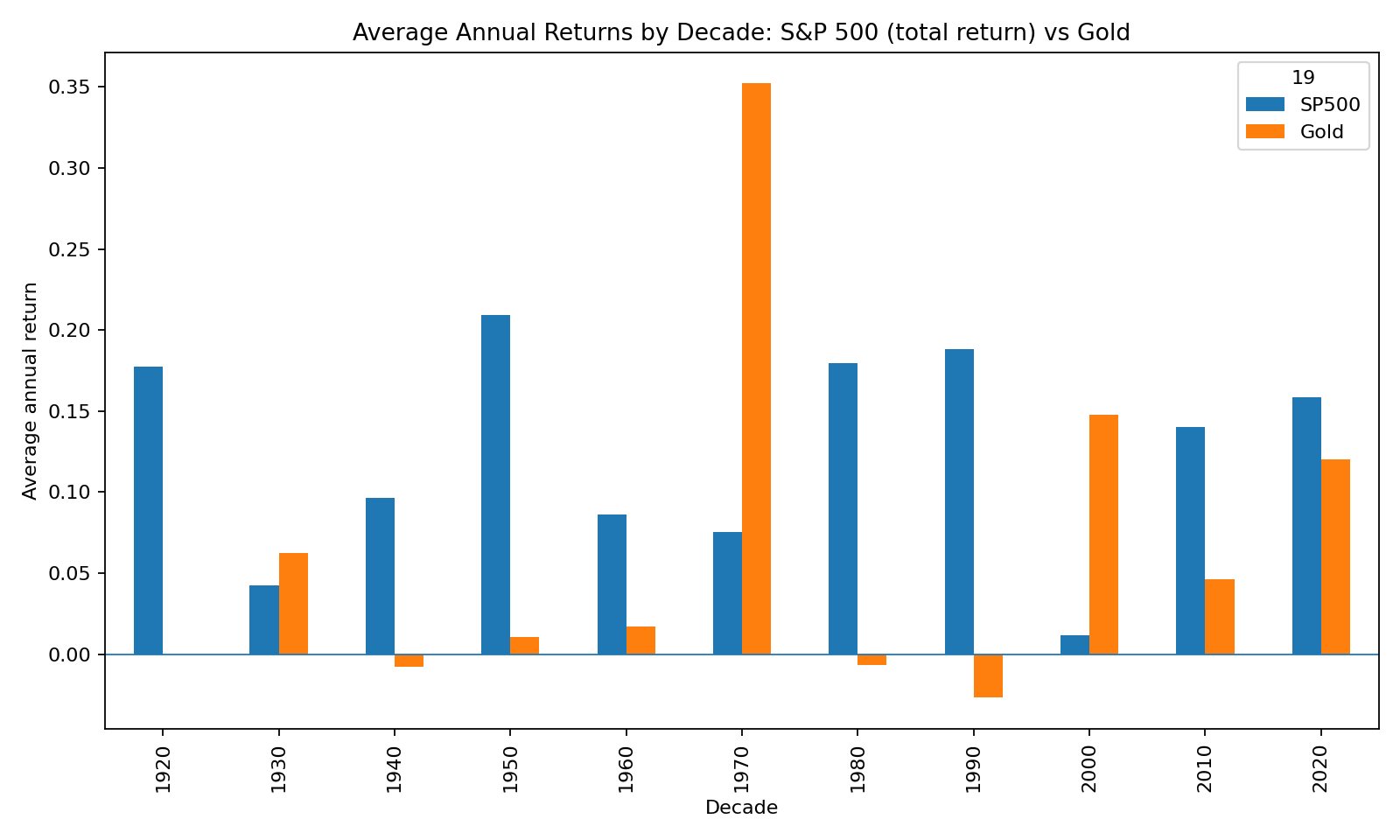

1) Leadership by Decade

How to read it: Bars show average annual returns by decade. Leadership rotates with the macro regime:

- 1950s–60s, 1980s–90s, 2010s: stocks dominated during growth and disinflation.

- 1970s & 2000s: gold led — inflation shocks and equity bear markets favored a store of value.

Why it matters: A plan that survives multiple regimes beats betting on just one. Decade bars remind us to diversify before the regime changes, not after.

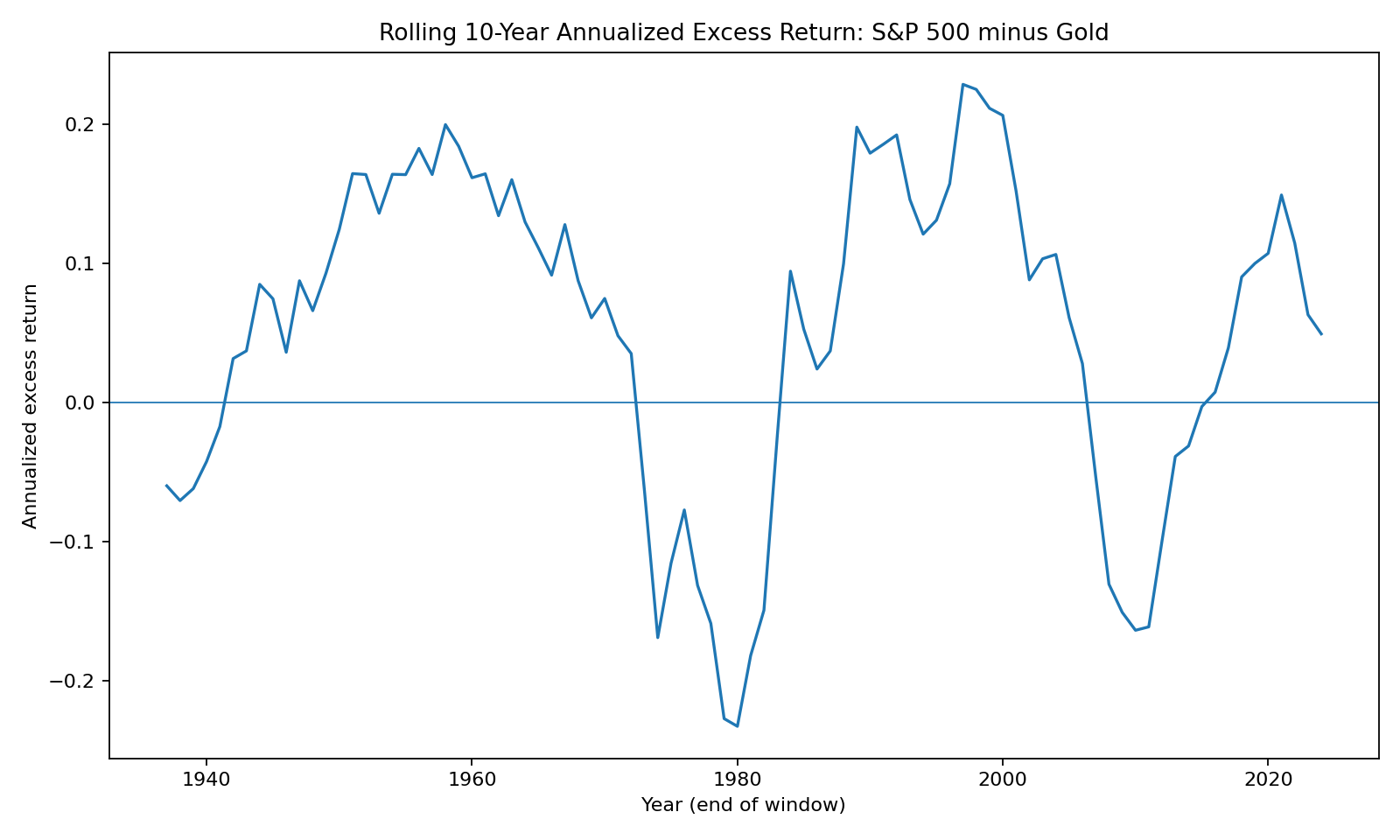

2) Ten-Year Reality Check (Rolling Premium)

How to read it: Above zero = stocks beat gold over the prior 10 years; below zero = gold beat stocks.

- Long stretches favor stocks (’50s–’60s, ’90s, ’10s).

- Other stretches favor gold (’70s, ’00s).

Why it matters: Investors live in decades, not days. Either asset can lag for 10+ years; sizing and patience are key.

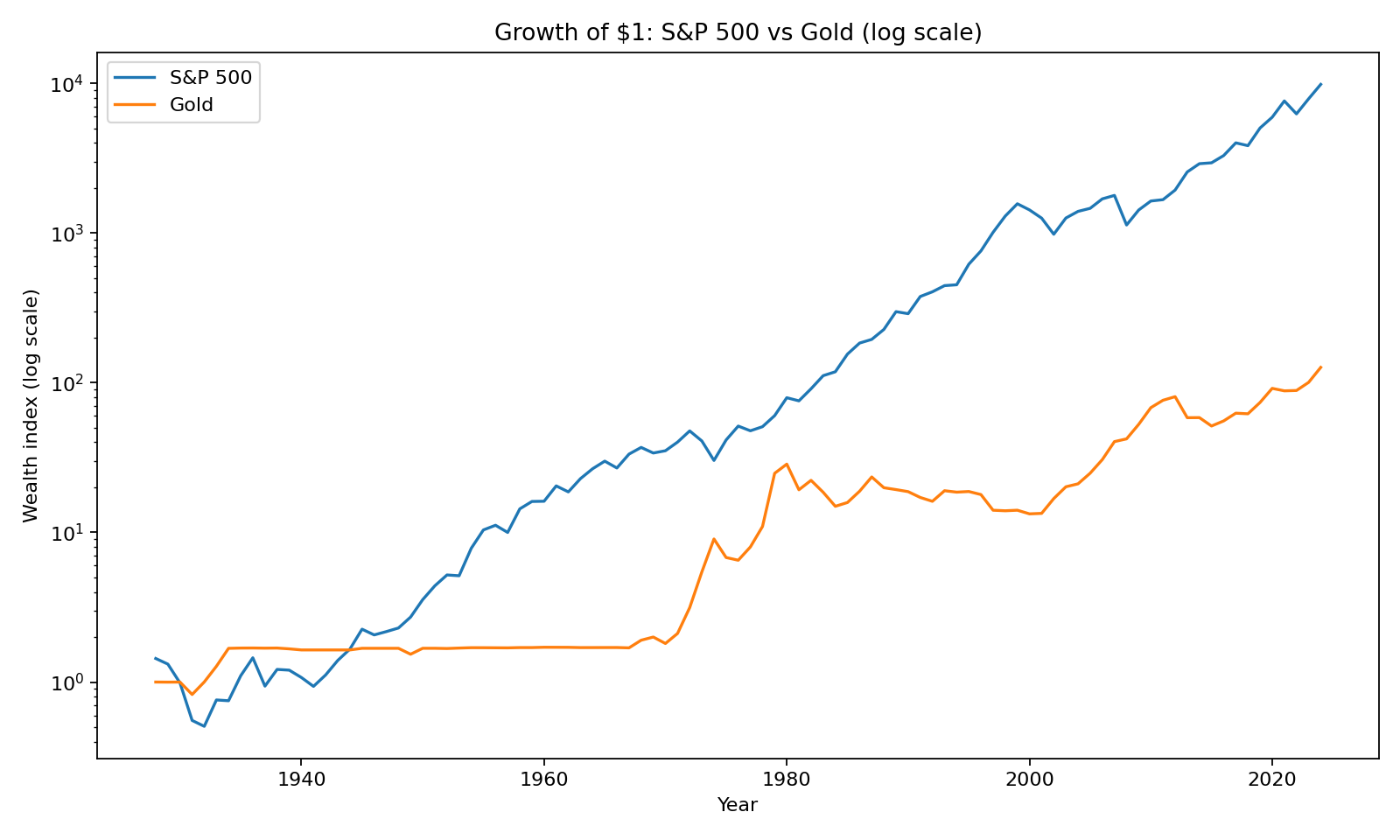

3) Wealth Building Over Time

How to read it: Growth of $1 since 1928 (log scale). The gap shows the compounding edge of stocks.

- Stocks are productive assets (earnings + dividends), so compounding drives much higher terminal wealth.

- Gold’s job is resilience, not growth — it doesn’t produce cash flows, but can protect purchasing power in shocks.

Portfolio takeaway: Keep stocks as the core engine; use gold as a complement, not a replacement.

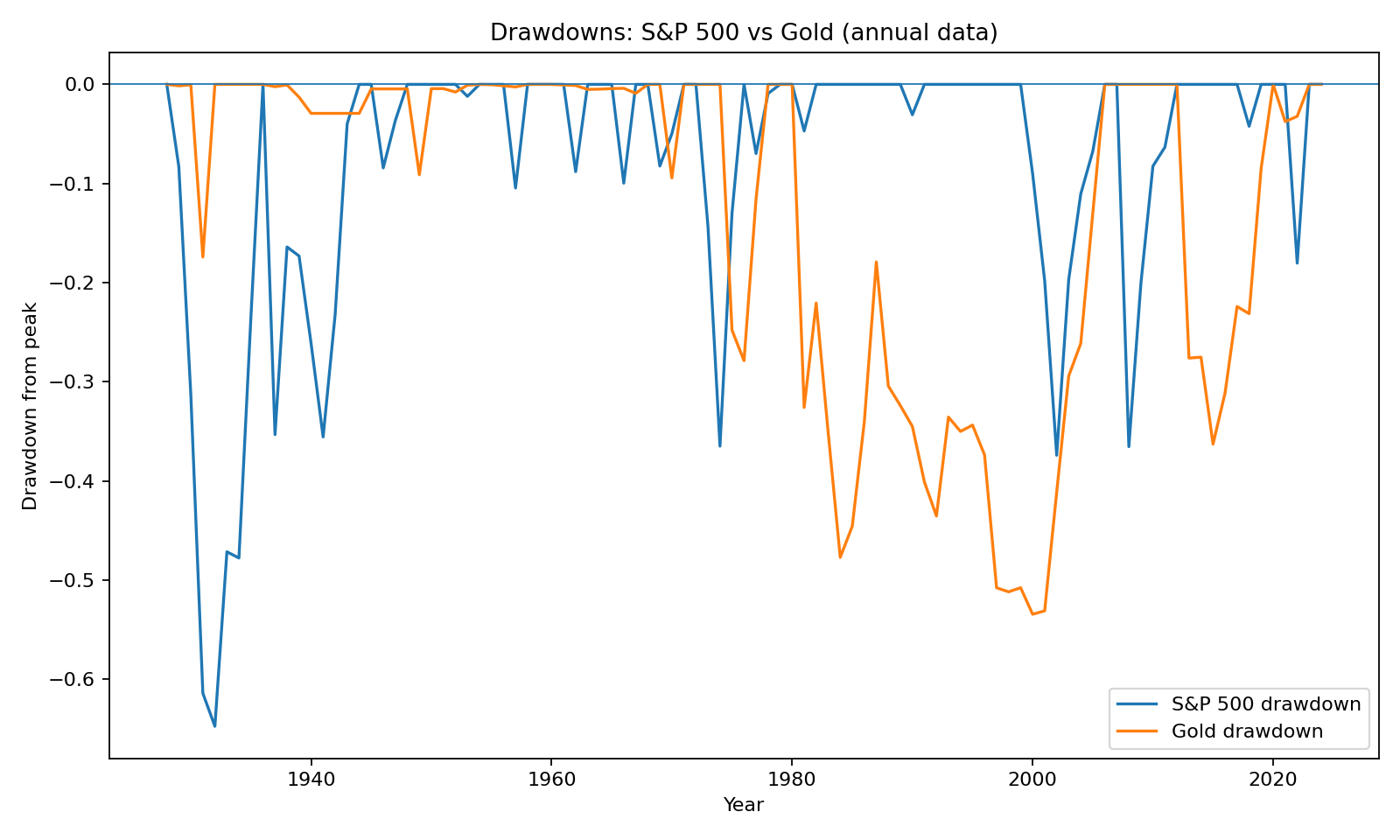

4) Drawdowns: Different Risks, Different Timing

How to read it: Drawdowns from prior peaks (annual data). Both assets can fall hard — just not at the same time.

- Stocks suffer most in recessions/bear markets.

- Gold can see deep, multi-year slides after big runs.

Portfolio takeaway: A small gold sleeve can cushion equity stress periods. But gold is not “risk-free”; it’s a different risk.

Putting It to Work (for Long-Term ETF Investors)

- Core & satellite: Keep a broad stock index fund as the core. Add a modest gold sleeve (e.g., single-digit %) to hedge inflation or crisis risk.

- Rebalance rules: Rebalance on a schedule (e.g., annually) or when weights drift. This systematically trims winners and adds to laggards across regimes.

- Stay horizon-true: Judge results over 5–10-year windows. Use the rolling-premium chart as a discipline tool, not a trading signal.

- Know your why: Hold stocks for growth; hold gold for resilience. Size each to your need for return vs. stability.