Stocks vs Bonds — Understanding the Long-Run Tradeoff

Most beginner investors hear they should own both stocks and bonds — but why?

The answer lies in history: stocks tend to deliver higher growth, while bonds add stability.

This post explores that tradeoff using nearly a century of U.S. data (1928–2024), drawing on NYU Professor Aswath Damodaran’s dataset.

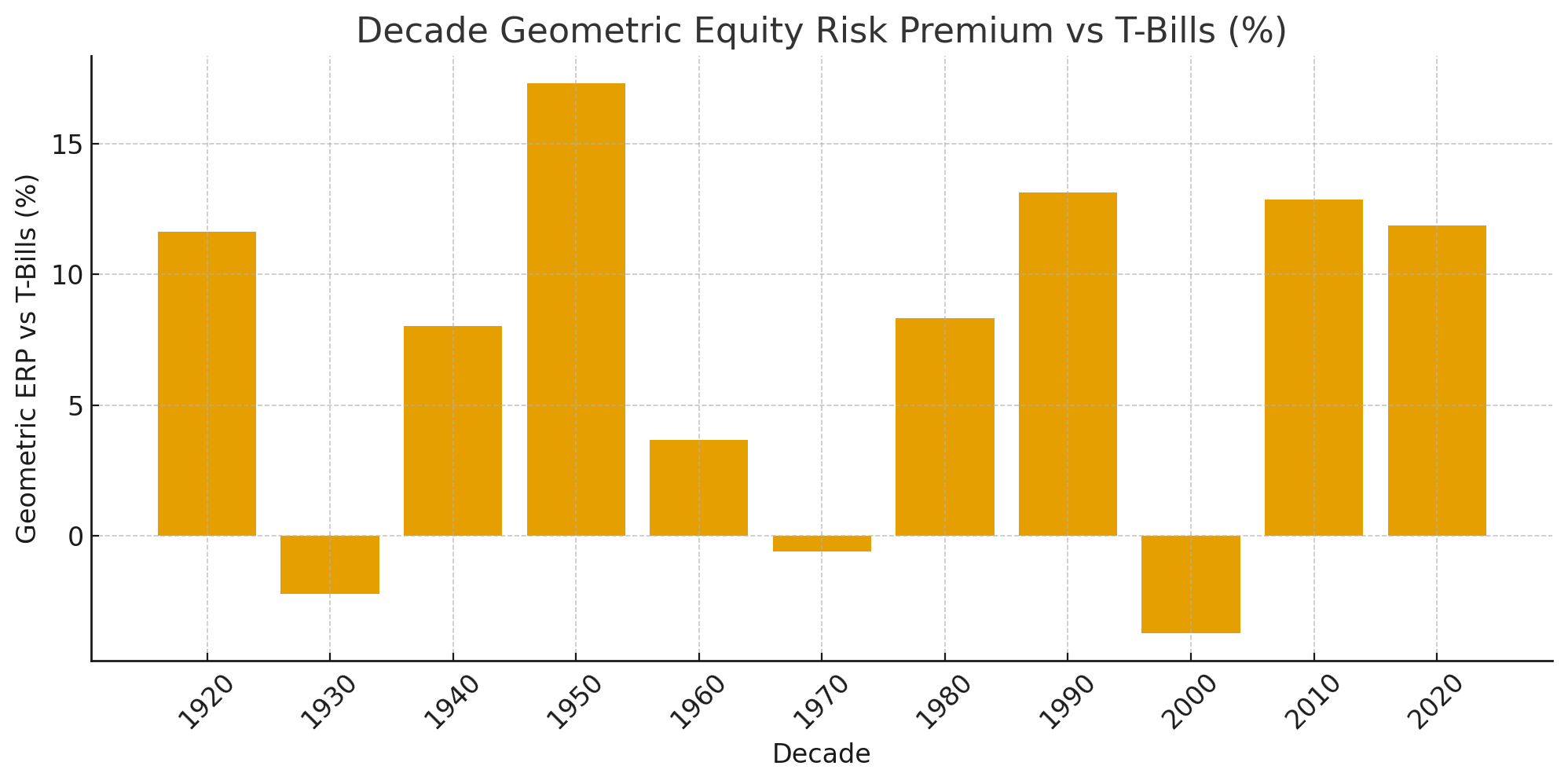

Stocks vs Bonds in one chart

Figure A

- In most decades, stocks beat safe assets.

- But not always: the 1930s and 2000–2010 were painful stretches where bonds (or even cash) looked better.

- Lesson: the equity premium exists, but it’s not guaranteed in your investing lifetime.

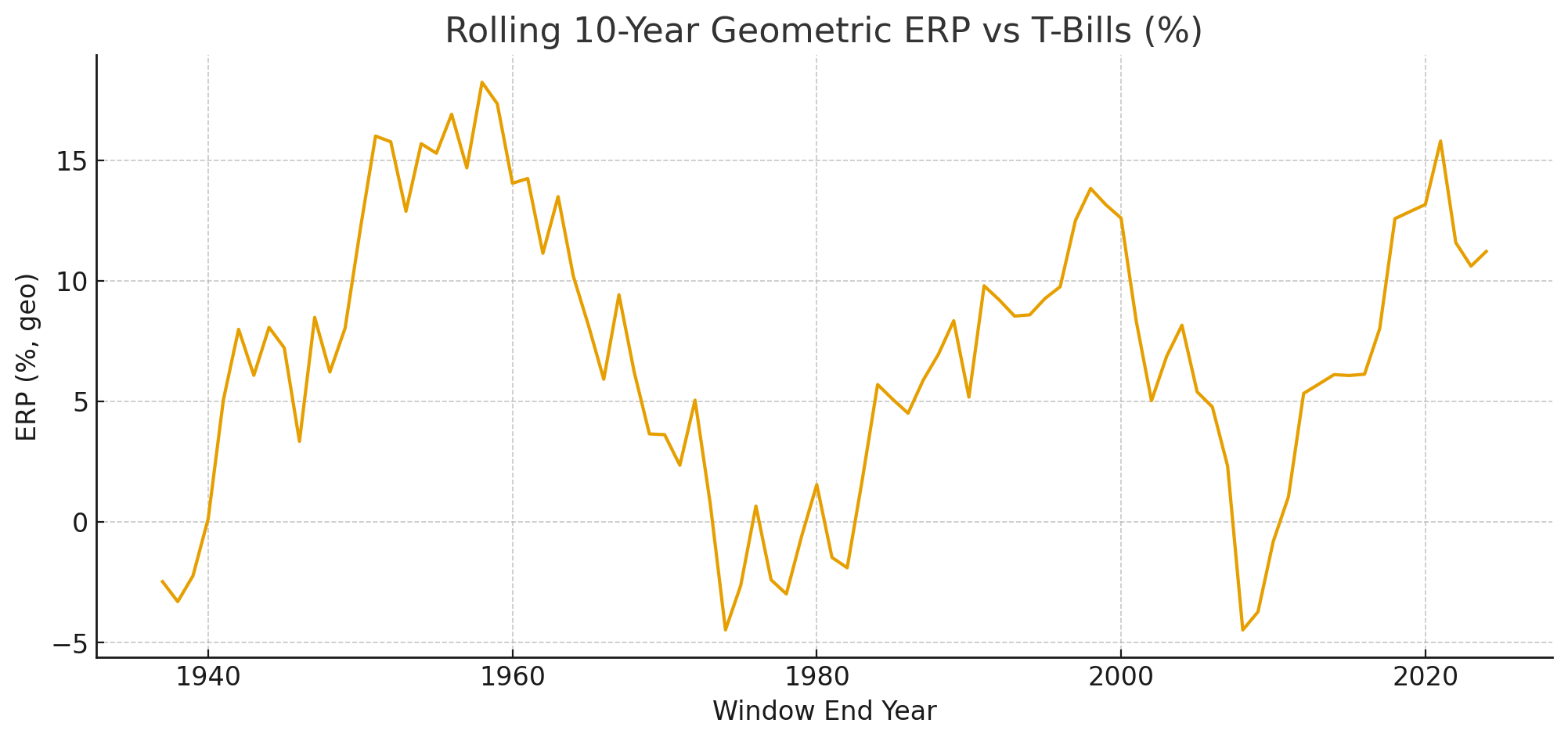

Rolling 10-Year Premiums: Patience Tested

Figure B

- Over many 10-year stretches, stocks did 5–7% per year better than cash.

- Yet some windows (1930s, 2000s) show a negative premium — stocks lagged.

- This is where investor psychology matters: holding stocks through such barren decades requires patience and discipline.

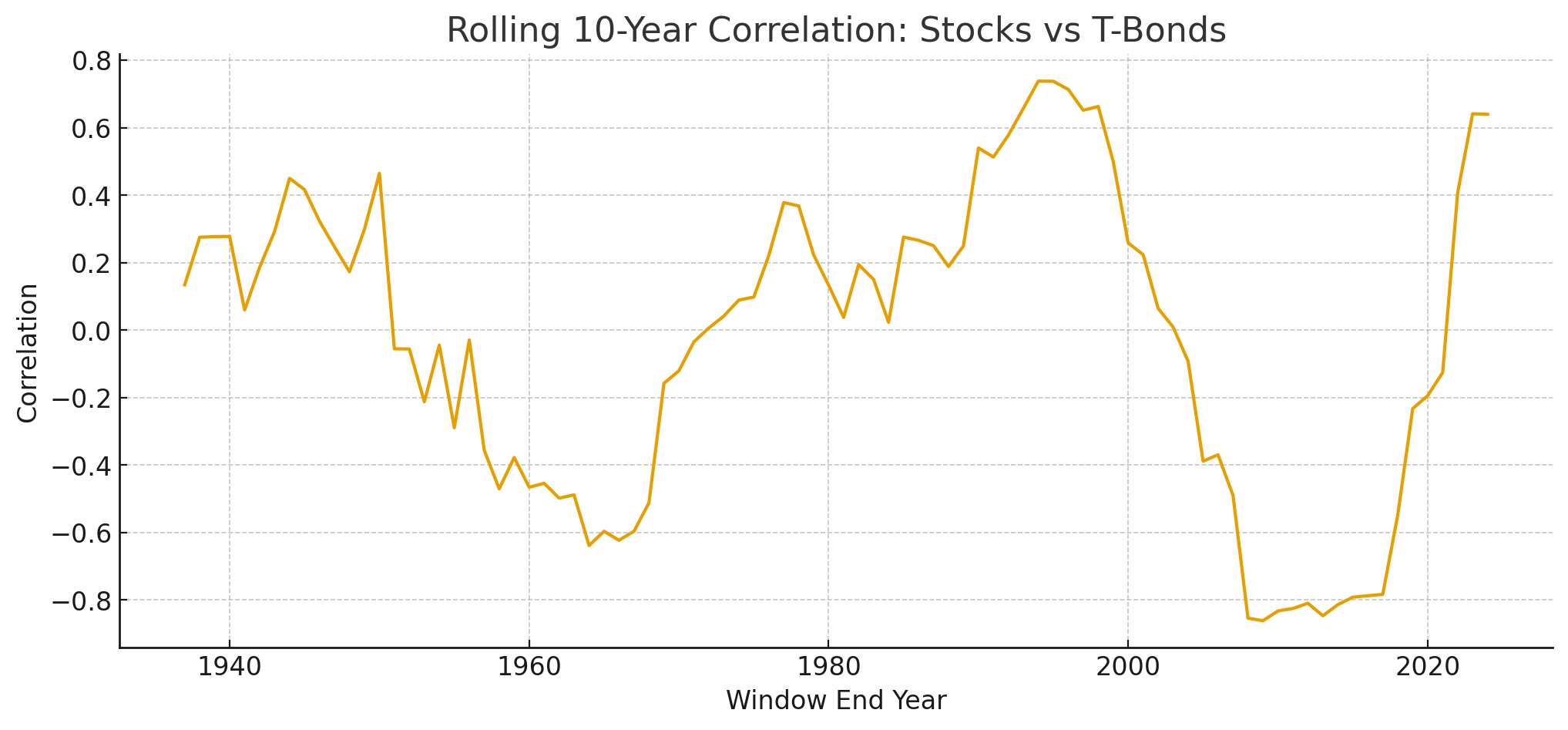

Bonds as a Counterweight

Figure C

- Sometimes stocks and bonds move together (1970s inflation).

- Sometimes they move opposite (2000s–2010s), giving bonds strong diversification value.

- A 60/40 portfolio works because bonds can cushion stock drawdowns — but that benefit depends on the era.

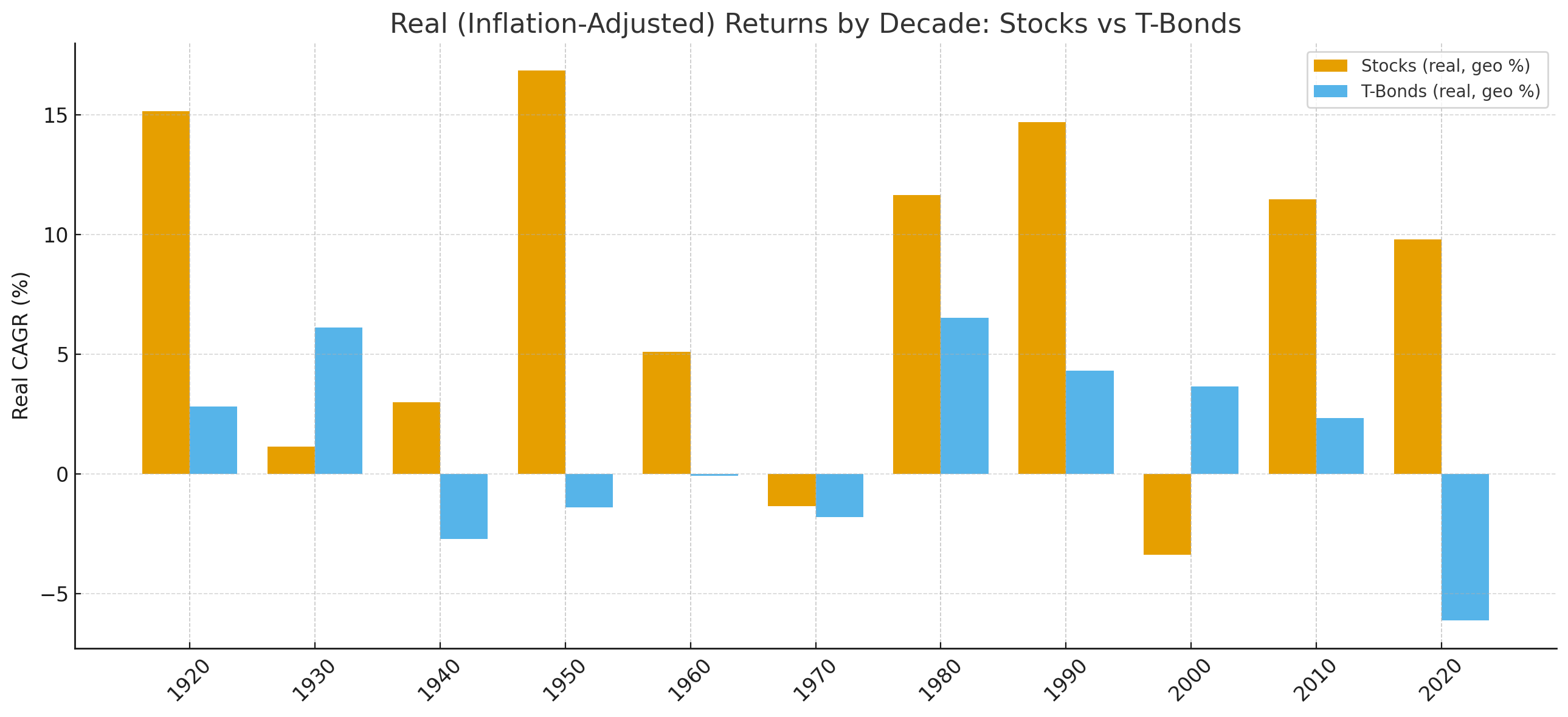

Real Returns: Inflation Matters

Figure D

- In high-inflation decades (1970s), bonds were crushed in real terms.

- Stocks suffered too, but often fared better than bonds.

- In disinflationary decades (1980s–2010s), bonds did well — sometimes rivaling stocks.

Investor Takeaways

- Stocks grow wealth — over the long run, equities have outpaced bonds and cash.

- Bonds steady the ride — they don’t just lower volatility; in some eras, they saved portfolios from ruin.

- The mix matters — a balanced stock/bond allocation adapts better across regimes than all-in bets.

- Patience is required — a “lost decade” in stocks or bonds is normal; the reward is in sticking with a sensible mix.

Bottom line

The equity risk premium — stocks’ edge over bonds and cash — is real, but uneven.

A diversified plan that blends growth from stocks with stability from bonds, plus the patience to hold through lean years, is what gives investors the best shot at compounding wealth.

In the next posts of this series, we’ll look at how stocks compare to gold and real estate as long-term rivals and complements.