The Small Cap Premium: Reward and Risk Since 1928

At Libra Invest, we believe that the best investment decisions are grounded in historical evidence. One of the most debated topics in finance is the small cap premium — the idea that investing in smaller companies leads to higher long-term returns compared to large-cap stocks like those in the S&P 500. Using annual returns from 1928 to 2024, let’s explore how this premium has unfolded.

The Numbers Behind the Premium

Over nearly a century:

- Average annual return (1928–2024):

- S&P 500 (with dividends): 11.8%

-

US Small Caps (bottom decile): 17.5%

-

Volatility (standard deviation of returns):

- S&P 500: 19.5%

- Small Caps: 37.9%

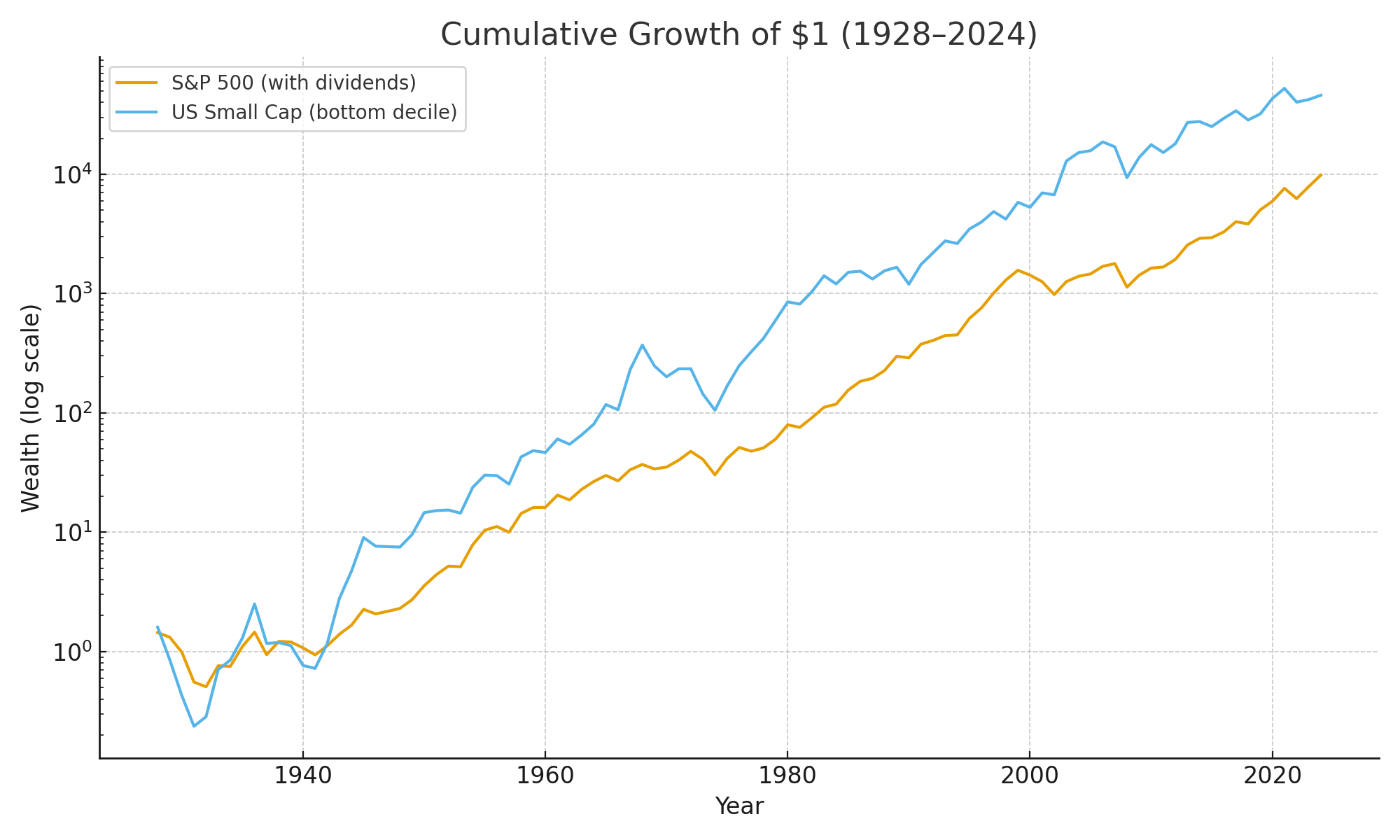

This means small caps generated almost 50% higher annual returns, but also carried roughly double the volatility. The payoff is striking:

- $1 invested in the S&P 500 in 1928 grew to $983,000 by 2024.

- The same $1 in small caps grew to $4.6 million.

Why Small Caps Outperform

Smaller companies tend to be riskier: less established businesses, fewer financial resources, and greater sensitivity to economic downturns. Investors demand higher returns for taking this risk, which explains the long-run premium.

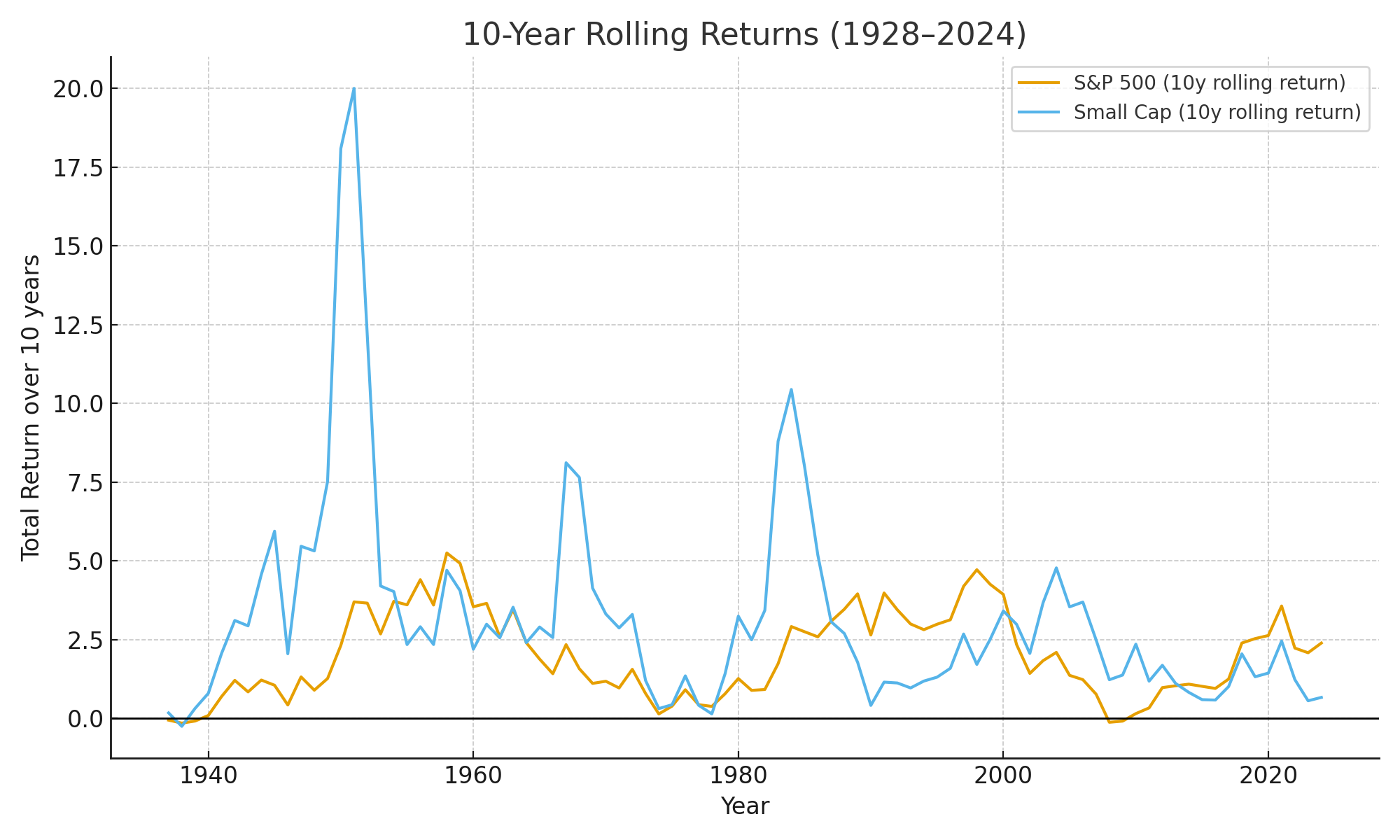

But the ride is far from smooth. Small caps:

- Crash harder in downturns (e.g., 2008: –45% vs –37% for the S&P).

- Bounce stronger in recoveries (e.g., 2003: +92% vs +28% for the S&P).

The chart below shows rolling 10-year returns. Notice how small caps swing higher in good decades but can also underperform for long stretches.

The Investor’s Takeaway

The small cap premium is real, but it comes with deep drawdowns and periods of frustration. Investors who stayed disciplined over the long run were rewarded with outsized wealth.

For most people, the lesson isn’t to go “all in” on small caps, but to consider them as part of a diversified portfolio. Balancing small caps with large caps, bonds, real estate, or even gold can provide a smoother journey without giving up the potential for higher returns.

At Libra Invest, our role is to help you harness these historical lessons — capturing growth while managing the risks.